Introduction to Check Cashing

Check cashing is a service that allows individuals to cash their checks without having to deposit them into a bank account. This can be especially useful for people who do not have a bank account or prefer not to use traditional banking services. With the rise of online banking and mobile payment systems, check cashing has become less popular, but it still remains a vital service for many individuals. In this article, we will explore the different options available for check cashing near you and provide a comprehensive guide on how to use these services.

Benefits of Check Cashing

Check cashing offers several benefits, including: * Convenience: Check cashing services are often available at convenient locations, such as grocery stores, pharmacies, and check cashing stores. * Flexibility: Check cashing services can be used to cash a variety of checks, including payroll checks, government checks, and money orders. * Speed: Check cashing services typically provide immediate access to cash, which can be helpful in emergency situations. * No bank account required: Check cashing services do not require a bank account, making them accessible to individuals who do not have a traditional banking relationship.

Check Cashing Near Me Options

There are several options available for check cashing near you, including: * Check cashing stores: These stores specialize in check cashing and often offer other financial services, such as money orders and bill pay. * Grocery stores: Many grocery stores offer check cashing services, either through a dedicated check cashing counter or at the customer service desk. * Pharmacies: Some pharmacies, such as CVS and Walgreens, offer check cashing services. * Convenience stores: Many convenience stores, such as 7-Eleven, offer check cashing services. * Bank branches: Some bank branches offer check cashing services, even for non-account holders. * ATM check cashing: Some ATMs offer check cashing services, allowing individuals to deposit a check and receive cash. * Mobile check cashing apps: Several mobile apps, such as Ingo Money and Check Cashing Store, offer check cashing services, allowing individuals to deposit a check and receive cash or load the funds onto a prepaid debit card. * Money centers: Some money centers, such as MoneyGram and Western Union, offer check cashing services. * Post offices: Some post offices offer check cashing services, especially for government checks. * Credit unions: Some credit unions offer check cashing services, especially for members.

How to Use Check Cashing Services

Using check cashing services is relatively straightforward. Here are the steps to follow: * Find a check cashing location: Use online directories or mapping apps to find a check cashing location near you. * Verify the check cashing policy: Call ahead to verify the check cashing policy, including the types of checks accepted and any fees associated with the service. * Gather required documents: Typically, you will need to provide identification, such as a driver’s license or state ID, and the check you want to cash. * Endorse the check: Sign the back of the check to endorse it. * Present the check and ID: Present the check and ID to the check cashing attendant. * Receive cash: Once the check is verified, you will receive cash for the face value of the check, minus any fees.

Fees Associated with Check Cashing

Check cashing services typically charge fees, which can range from 1% to 5% of the face value of the check. These fees can vary depending on the location and type of check being cashed. Some common fees associated with check cashing include: * Check cashing fee: This fee is charged for cashing the check and can range from 1% to 5% of the face value. * Verification fee: This fee is charged for verifying the check and can range from 1 to 5. * Handling fee: This fee is charged for handling the check and can range from 1 to 5.

Table of Check Cashing Fees

| Check Cashing Location | Check Cashing Fee | Verification Fee | Handling Fee |

|---|---|---|---|

| Check Cashing Store | 2% of face value | 2</td> <td>1 | |

| Grocery Store | 1% of face value | 1</td> <td>0.50 | |

| Pharmacy | 3% of face value | 3</td> <td>2 | |

| Convenience Store | 4% of face value | 4</td> <td>3 |

👉 Note: Fees can vary depending on the location and type of check being cashed. It's always a good idea to call ahead and verify the fees associated with the check cashing service.

In summary, check cashing is a convenient and flexible way to access cash from a check without having to deposit it into a bank account. There are several options available for check cashing near you, including check cashing stores, grocery stores, pharmacies, and convenience stores. By following the steps outlined in this article and being aware of the fees associated with check cashing, you can use these services with confidence.

What types of checks can be cashed at a check cashing store?

+

Check cashing stores typically accept a variety of checks, including payroll checks, government checks, and money orders. However, it’s always best to call ahead and verify the types of checks accepted by the specific store.

How much does it cost to cash a check at a grocery store?

+

The cost to cash a check at a grocery store can vary depending on the store and the type of check being cashed. Typically, grocery stores charge a fee ranging from 1% to 3% of the face value of the check.

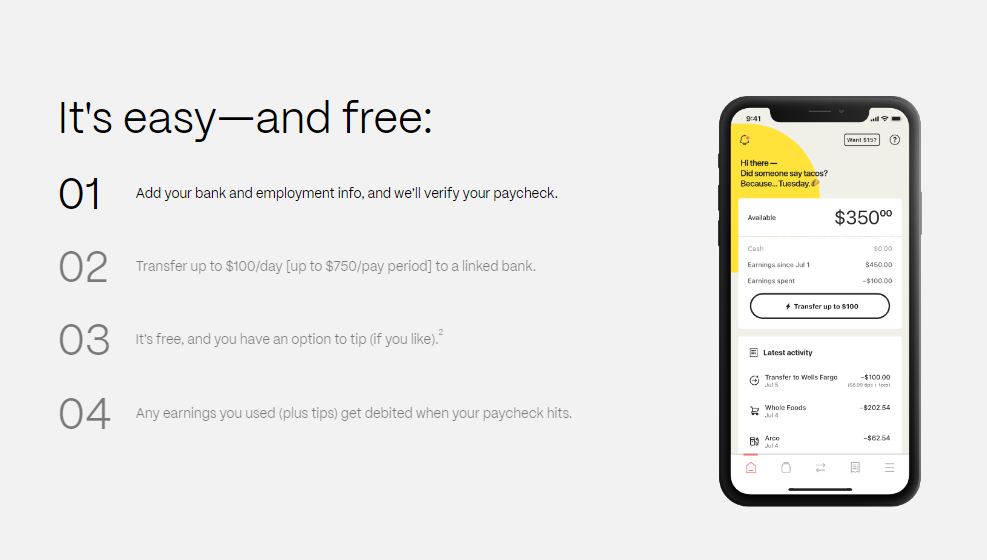

Can I cash a check at an ATM?

+

Some ATMs offer check cashing services, allowing individuals to deposit a check and receive cash. However, this service is not available at all ATMs, and fees may apply.

Do I need a bank account to use check cashing services?

+

No, you do not need a bank account to use check cashing services. Check cashing services are designed for individuals who do not have a traditional banking relationship or prefer not to use traditional banking services.

Can I cash a check online?

+

Yes, there are several online check cashing services available, such as Ingo Money and Check Cashing Store. These services allow individuals to deposit a check and receive cash or load the funds onto a prepaid debit card.