Introduction to Money Orders

When it comes to making payments, especially for large or important transactions, security and reliability are key. One often overlooked but highly effective payment method is the money order. A money order is a payment order for a specified amount of money, similar to a check, but with a few key differences that make it more secure. In this article, we will delve into the world of money orders, exploring what they are, how they work, and providing six professional tips on how to use them effectively.

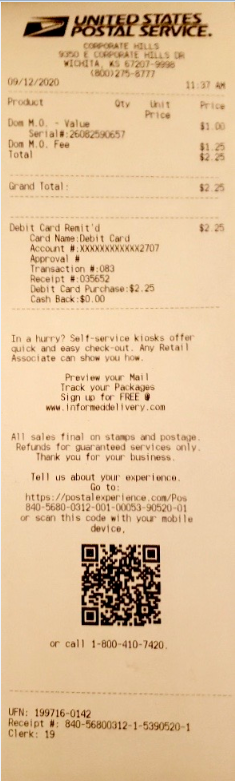

What is a Money Order?

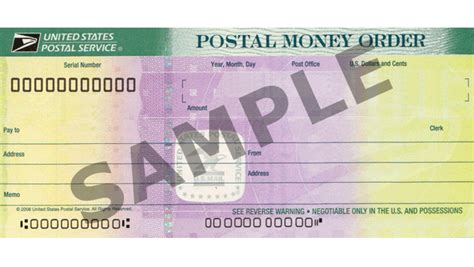

A money order is a type of payment instrument that represents a predetermined amount of money. It’s essentially a check that’s guaranteed by the issuer, making it a more reliable form of payment than a personal check. Money orders can be purchased from various sources, including post offices, banks, and some retail stores. They are often used for transactions where cash is not preferred or when a more secure payment method than a check is required.

How Do Money Orders Work?

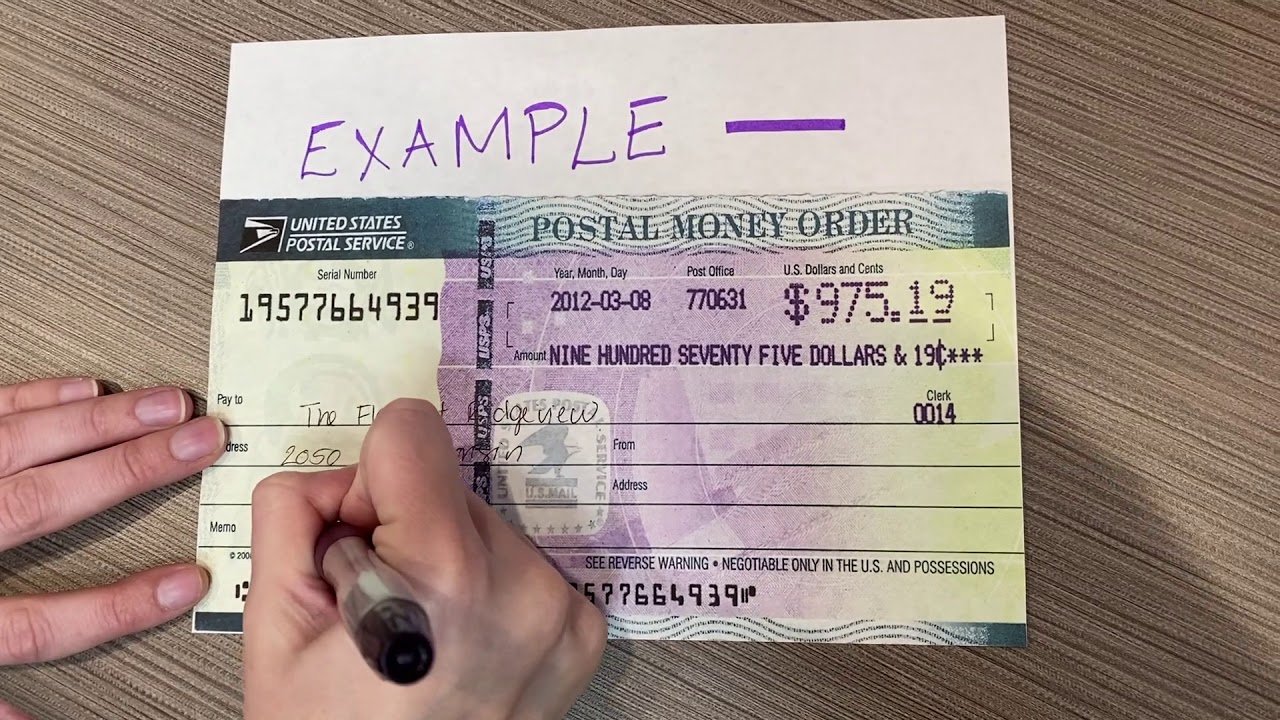

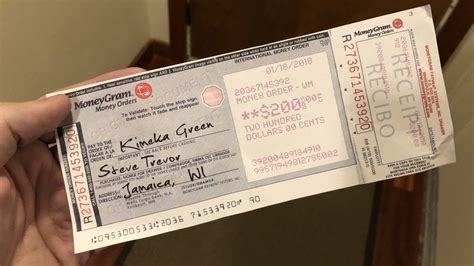

To use a money order, you first need to purchase one from an authorized vendor. The process typically involves: - Paying the Amount: You give the vendor the amount you want the money order to be for, plus a small fee for the service. - Filling Out the Money Order: You fill in the recipient’s name and your name (as the purchaser) on the money order, though some money orders may require additional information. - Receiving the Money Order: The vendor gives you the completed money order, which you can then mail or hand-deliver to the recipient.

Benefits of Using Money Orders

Money orders offer several benefits, including: - Security: Since money orders are prepaid, there’s no risk of insufficient funds or bounced checks. - Reliability: The recipient is guaranteed to receive the payment, making it ideal for transactions that require certainty. - Convenience: Money orders can be purchased from various locations and can be used for both local and international transactions.

6 Professional Money Order Tips

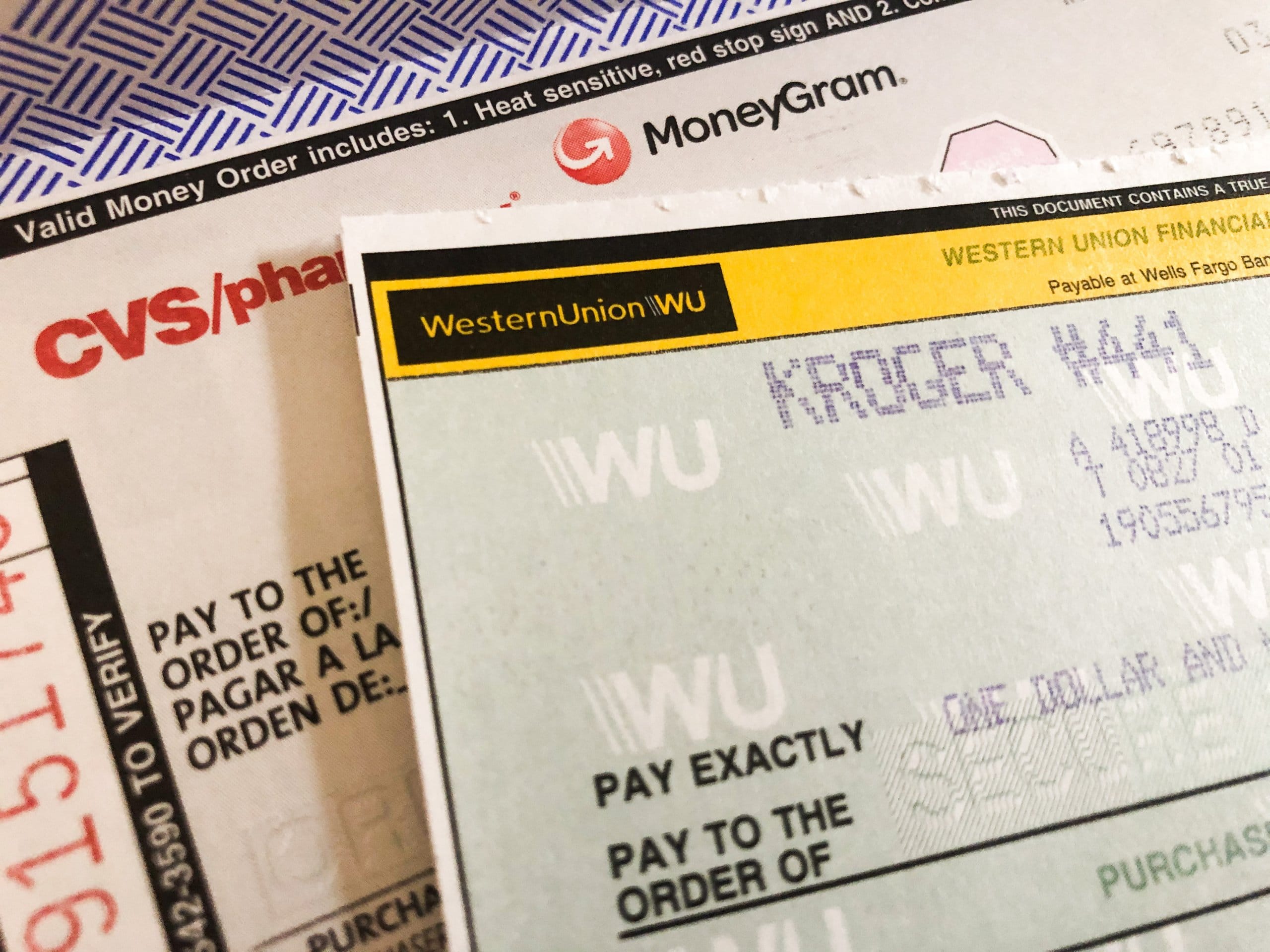

To get the most out of using money orders, consider the following tips: - 1. Choose the Right Vendor: Opt for a reputable vendor to purchase your money orders. The U.S. Postal Service and Western Union are popular choices. - 2. Keep Your Receipt: Always keep the receipt you get when purchasing a money order. It serves as proof of purchase and can be necessary for tracing or replacing a lost money order. - 3. Fill It Out Correctly: Ensure that all fields on the money order are filled out accurately. Incorrect or incomplete information can lead to delays or issues with the transaction. - 4. Understand the Fees: Different vendors charge different fees for money orders. Compare prices to find the best deal for your needs. - 5. Consider the Limits: There are usually limits on how much you can purchase in a single money order. Be aware of these limits when planning your transaction. - 6. Use for Secure Transactions: Money orders are ideal for transactions where security is paramount. Use them for rent payments, sending money internationally, or for any transaction where you want to ensure the payment is secure and traceable.

📝 Note: When purchasing a money order, ensure you get a receipt and keep it safe, as it will be required if the money order is lost or stolen and needs to be traced or replaced.

Common Uses for Money Orders

Money orders are versatile and can be used in a variety of situations, including: - Rent payments - Utility bills - Sending money internationally - Paying for goods or services where a secure payment method is preferred - Legal transactions where a record of payment is necessary

| Vendors | Fees | Maximum Amount |

|---|---|---|

| U.S. Postal Service | Varies by location | $1,000 for domestic, $700 for international |

| Western Union | Varies by location and amount | Varies by location and type of money order |

International Money Orders

For international transactions, money orders can be particularly useful. However, it’s crucial to understand the exchange rates and any additional fees that might apply. Not all money orders can be used internationally, so it’s essential to specify that you need an international money order when purchasing.

As we summarize the key points of using money orders, it’s clear that they offer a secure, reliable, and convenient way to make payments. By following the six professional tips outlined and understanding how money orders work, you can utilize this payment method effectively for your needs. Whether you’re making a domestic or international transaction, money orders are a viable option that ensures your payment is secure and guaranteed.

What is the main advantage of using a money order over a check?

+

The main advantage is that money orders are prepaid, eliminating the risk of insufficient funds or bounced checks, making them a more secure form of payment.

Can money orders be used internationally?

+

Yes, money orders can be used internationally, but you must specify that you need an international money order when purchasing. Not all money orders are valid for international use.

How do I replace a lost money order?

+

To replace a lost money order, you will typically need the receipt from when you purchased it. Contact the issuer for specific instructions on how to proceed with tracing or replacing the money order.